Capacity Related Costs Includes Which of the Following

It includes any time spent writing standards reviewing documents meeting to analyze the root causes of defects rework to fix the defects once theyre found by the team -. D All of the above.

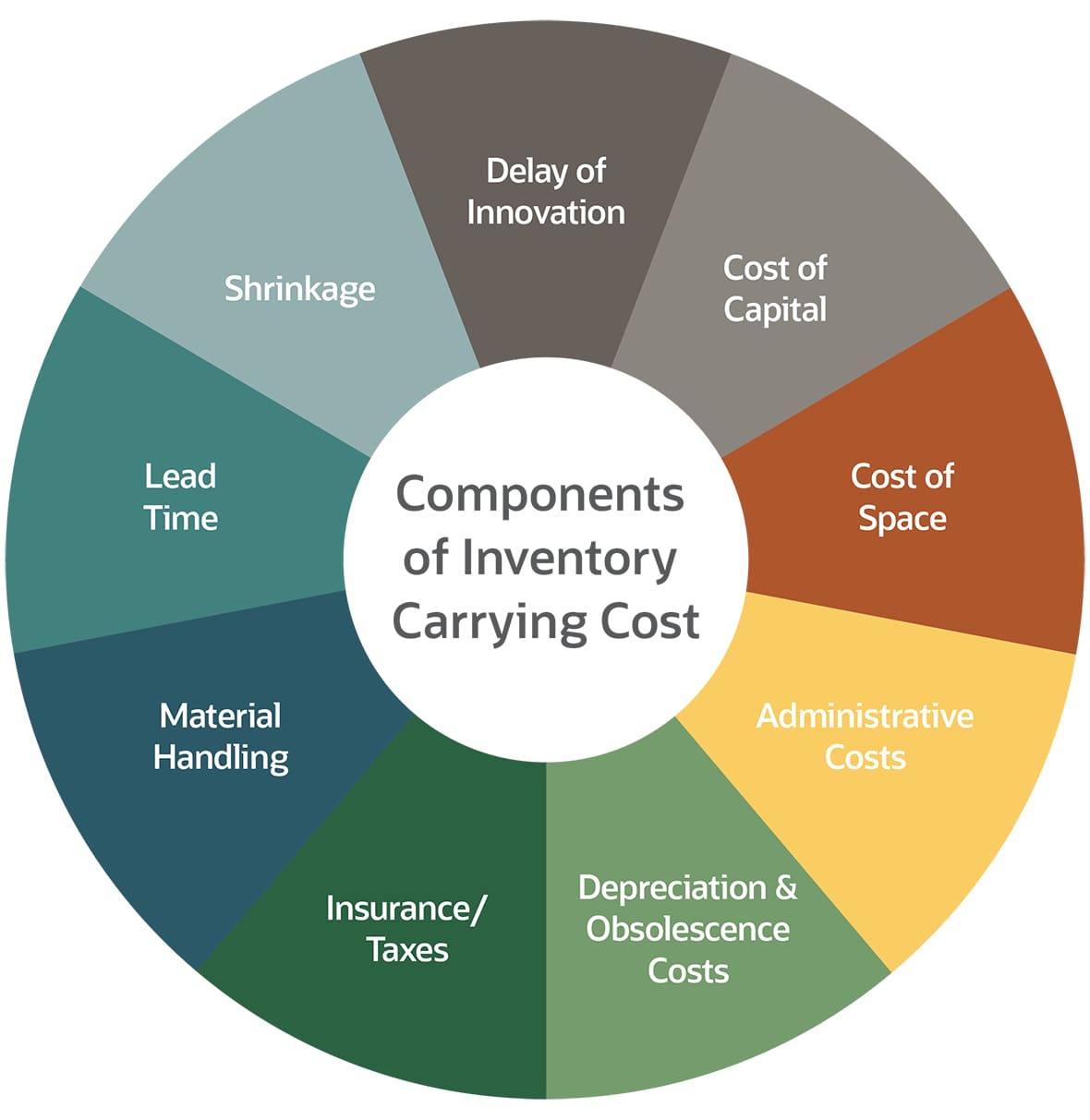

Inventory Carrying Costs What It Is How To Calculate It Netsuite

Which of the following is true of capacity costs.

. Insurance costs incoming freight costs and setup costs. B In a cost-benefit analysis both costs and benefits are easy to obtain. B Low profit earning capacity of the firm.

When production volume increases in a cellular manufacturing system where costs are assigned using cycle time b. An activity which is related to the facility capacity as a whole is a. A B and C.

A wide range of costs can be included in the capacity cost concept. For example if an organization constructs a manufacturing facility to expand its capacity it will incur costs for building and equipment depreciation and maintenance insurance on the facility and equipment property taxes security for the building and utilities. Idle capacity cost decreases.

Setup costs of 100000 are based on number of batches. All of the following are examples of drawbacks of using absorption costing. Which of the following statements is not true about capacity management in operations.

The carrying costs pertaining to inventory include. Settlement FeesClosing Costs. Product unit cost decreases b.

B normal capacity utilization for benchmarking purposes C practical capacity for pricing decisions D theoretical capacity for performance evaluation 7 Customers expect to pay a price that includes _____. During year 1 MNX Company. 31522 1218 PM Quiz.

Plant service costs of 65000 are based on square footage. ACCT 3121 Chapter 9 Practice. Other information for 2017 includes.

Costs of buying from the outside vendor E. A and b e. Spring Company uses activity based costing to allocate their overhead cost.

Cost incurred while an item capable of operating in the manner intended by management has yet to be brought into use or is operated at less than full capacity. Units sold total 600 units. Utility installation service charges.

6 Which of the following statements about the cost-benefit approach is true. A Capacity costs are difficult to estimate. Purchased 100000 worth of direct materials incurred selling and administrative costs of 48000 18000 variable 30000 fixed produced 10000 units of plywood and sold 9000 units of plywood at a price of 30 for each unit.

Which of the following is a fixed cost. A Resources should be spent if they are expected to better attain company goals in relation to the expected costs of these resources. Insurance costs incoming freight costs and setup costs.

Operating costs are the ongoing expenses incurred from the normal day-to-day of running a business. Which of the following concepts or philosophies explicitly recognize the concept of variability. Spring company has identified 500 batches and.

B Capacity costs dont provide a useful planning tool for nonmanufacturing firms. If a company has sufficient excess capacity which of the following costs are relevant to the decision to make or buy a new product. CVP analysis may be used by managers in planning and decision-making which may involve the following except a.

Acctg 4233 - Exercises 19 PPE to Impairment - Theory 2022 equipment. Fixed manufacturing costs are related to the capacity to produce rather than to the actual production of specific units d. Insurance costs incoming freight costs and storage costs.

A High profit earning capacity of the firm. Insurance costs incoming freight costs and storage costs. Storage costs and opportunity cost of capital invested in inventory.

D All of the above. C Capacity costs cannot be used with activity-based costing. External sources of capacity.

6300 of actual fixed manufacturing costs is expensed as a lump sum Venus Corporation incurred fixed manufacturing costs of 6300 during 2017. The types of costs to consider when adding capacity are the cost of. A B and D only Part 2- Which of the following are reasons to discontinue an unprofitable business.

You can add various expenses connected to buying your property to your basis with the exception of fees and costs for obtaining a mortgage or property loan. Operating costs include both costs of goods sold COGS and other operating expensesoften. Question 9 0 1 pts Effects of too much capacity include all of the following except.

Includes the cost of unused capacity d. Classify the following cost associated in producing T-shirts as a variable fixed or mixed cost for units produced and sold. It doesnt just include the testing.

Setup costs and opportunity cost of capital invested in inventory. D High variable cost. Considerations in adding capacity include.

The Nature of Capacity Costs. Warehouse rent of 8000. It involves a systematic examination of the relationships among costs cost driver and profit a.

Setup costs and opportunity cost of capital invested in inventory. C High fixed cost. Financial statement analysis b.

Abstract of title fees. Frequency of capacity additions. A the cost of unused capacity B only the cost of actual capacity used C variable costs but not capacity costs D both actual and unused.

Large angle of incidence indicates. Which of the following concepts or philosophies explicitly recognize the concept of variability. Both a and c are correct.

Question 11 1 1 pts Ending a reliance on numerical goals would be associated with which of. Some of these expenses include. The carrying costs pertaining to inventory include a.

Question 10 1 1 pts Holding too little inventory ___ _ _ _ _ _ _ _ __ the risk of a stockout. Storage costs and opportunity cost of capital invested in inventory. Assume that there were no beginning inventories and the actual costs of production are equal to budgeted costs.

When production volume increases in a cellular manufacturing system where costs are assigned using cycle time a. The budgeted denominator level is 1600 units. Idle capacity cost decreases.

A High profit earning capacity of the firm. D Capacity costs do not arise in the nonmanufacturing parts of the value chain. Cost of quality is what you get when you add up the cost of all of the prevention and inspection activities you are going to do on your project.

Units produced total 770 units.

Solution Manual For Fundamentals Of Cost Accounting 4th By Lanen Anderson Maher Cost Accounting Accounting Fundamental

Seven Reasons Why Businesses Need External Funding Trade Finance Business External

Capacity Cushion Double Entry Bookkeeping Accounting Student Bookkeeping Accounting Major

Comments

Post a Comment